Introduction

The Used Vehicle Market encompasses the global trade of pre-owned automobiles, including passenger cars, light commercial vehicles, and, in some regions, motorcycles and heavy vehicles. This market serves as an essential pillar of the automotive ecosystem by providing affordable mobility options, broad consumer choice, and aftermarket services. The used vehicle market includes offline dealerships, independent resellers, auctions, and online platforms, all of which facilitate transactions between sellers and buyers. As vehicle lifecycles lengthen and digital retailing evolves, the used vehicle market continues to expand its reach and sophistication.

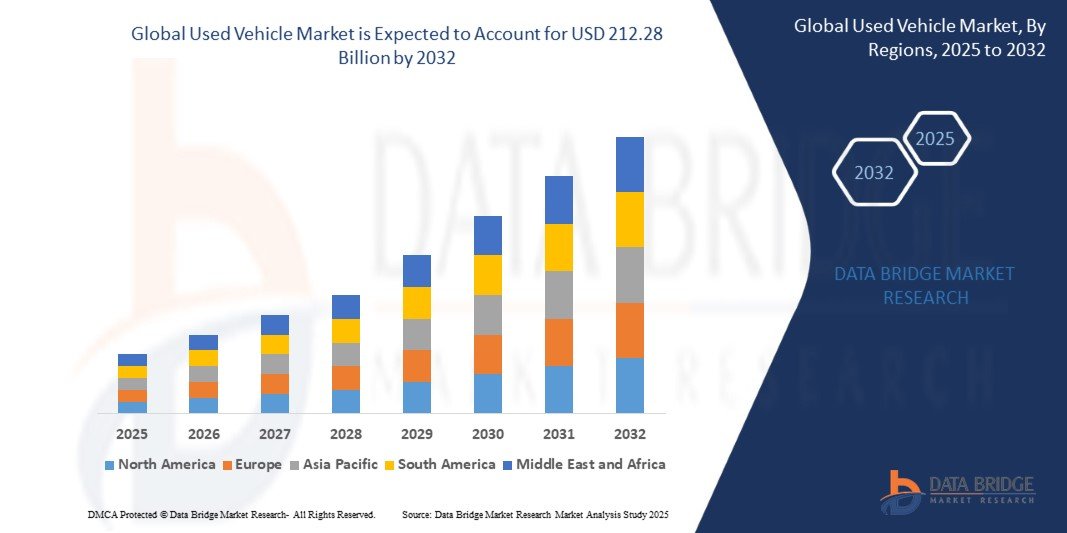

Market Size and Growth Projections

The used vehicle market has demonstrated resilient performance globally, often outpacing new vehicle sales during economic slowdowns and periods of supply constraints. The market is projected to grow at a steady compound annual growth rate (CAGR) over the forecast period, supported by rising global mobility demand, affordability pressures, expanded digital marketplaces, and demand for certified pre-owned (CPO) programs. Growth is particularly notable in emerging markets as urbanization and disposable incomes rise.

Get More Details : https://www.databridgemarketresearch.com/reports/global-used-vehicle-market

Key Growth Factors

- Increasing demand for affordable and reliable transportation

- Expansion of online marketplaces and digital retail platforms

- Growth in certified pre-owned (CPO) programs backed by OEMs

- Rising vehicle ownership in emerging economies

- Enhanced aftermarket financing and warranty services

Market Segmentation

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Two-Wheelers (selected regions)

- Electric Used Vehicles

Passenger cars account for the largest share due to broad consumer demand and frequent turnover cycles in urban and suburban regions.

By Sales Channel

- Independent Used Car Dealerships

- Franchised / OEM Certified Pre-Owned (CPO) Dealers

- Online Marketplaces and Digital Retailers

- Auctions & Broker Platforms

Online marketplaces have witnessed rapid growth as consumers increasingly prefer transparent pricing, remote inspections, and delivery services.

By End User

- Individual Consumers

- Fleet Buyers & Corporates

- Rental & Leasing Companies

- Small and Medium Enterprises (SMEs)

Individual consumers drive the majority of transactions, with fleet buyers and corporate users also contributing to volume, particularly for LCVs and HCVs.

Regional Insights

North America remains a highly mature and structured used vehicle market, with strong CPO programs, robust financing options, and well-established online platforms. Europe follows with significant cross-border trade and a high penetration of certified pre-owned offerings. The Asia-Pacific region is poised for the fastest growth, driven by expanding vehicle ownership, rising digital adoption, and growing middle-class consumer segments in China, India, Southeast Asia, and Australia. Latin America and Middle East & Africa exhibit steady expansion supported by urbanization and the increasing appeal of value-oriented used vehicles.

Key Market Drivers

The used vehicle market is fundamentally driven by cost considerations, with pre-owned vehicles offering significant price advantages and lower depreciation risks compared to new vehicles. Digital transformation — including online listings, virtual inspections, and e-commerce-enabled financing — enhances transparency and convenience, attracting younger and tech-savvy buyers. The rise of certified pre-owned programs backed by manufacturers adds confidence through warranties, inspection reports, and after-sales services. Additionally, environmental and sustainability considerations encourage extended vehicle lifecycles.

Market Challenges and Restraints

Challenges in the market include quality assurance and vehicle history transparency, which can influence buyer confidence. Price competition among independent sellers, fraud risks, and inconsistent inspection standards pose hurdles. In some regions, regulatory differences and tax structures can complicate cross-border sales and ownership transfers. Electric used vehicles present unique challenges related to battery health assessment, residual value uncertainty, and charging infrastructure readiness.

Competitive Landscape with Key Companies

- CarMax, Inc.

- AutoNation, Inc.

- Cox Automotive (Autotrader, Kelley Blue Book)

- Lithia & Driveway, Inc.

- Carvana Co.

- Vroom, Inc.

- Pendragon PLC

- TrueCar, Inc.

Market players focus on digital platform expansion, transparent pricing tools, financing and warranty services, home delivery, and post-sale support to differentiate offerings and build long-term buyer trust.

Technological Innovations

Technological advancements shaping the used vehicle market include vehicle history and telematics reporting, AI-powered pricing and valuation tools, virtual and augmented reality (VR/AR) vehicle tours, and blockchain-based ownership tracking. Integration with mobile apps, online financing tools, and automated inspection platforms improves convenience and reduces friction for buyers and sellers. Predictive analytics also supports inventory management and pricing strategies for dealers.

SWOT Analysis

| Strengths | Weaknesses |

|---|---|

| Affordable access to mobility | Variability in vehicle condition and quality |

| Digital platform convenience | Risk of fraud without robust transparency |

| Certified pre-owned confidence | Complexity in cross-border regulation |

| Opportunities | Threats |

|---|---|

| Growth in online retail and e-commerce | Economic downturns affecting discretionary spending |

| Expansion of EV used vehicle segments | Regulatory and tax barriers |

| Integration with fintech services | Competition from new mobility models |

Future Market Outlook

The future outlook for the used vehicle market is positive as digital adoption deepens and consumers increasingly seek value, convenience, and trusted buying experiences. Growth in electric and hybrid used segments, supported by standardized battery health assessments and charging infrastructure investments, will broaden market appeal. Continued innovation in AI valuation models, dealer-to-consumer platforms, and integrated financing solutions will shape a more efficient and transparent market. Partnerships between OEMs, technology providers, and financial institutions will further enhance the ecosystem, especially for certified pre-owned programs.

Conclusion

The Used Vehicle Market remains a resilient and essential component of the global automotive landscape, offering affordable mobility, broad consumer choice, and dynamic digital retail experiences. With evolving customer expectations, enhanced transparency, and integrated services, the market is poised for continued growth and structural transformation. As online platforms, certification standards, and value-added services expand, used vehicle trading will continue to be a gateway to accessible and sustainable transportation worldwide.