Austin, Texas, often called “Silicon Hills,” has become a powerhouse in the semiconductor industry, particularly in the realm of semiconductor equipment. This city, known for its vibrant tech ecosystem, hosts a wide range of companies that design, manufacture, and service the sophisticated machinery used to produce semiconductors. These chips power everything from smartphones to cars and medical devices, making the equipment behind them critical to modern technology.

Austin’s unique blend of talent, infrastructure, and business-friendly policies has positioned it as a global leader in this field. In this exploration, we’ll dive into why Austin is a hotspot for semiconductor equipment, the key players driving this industry, the economic and educational factors fueling growth, and the future potential of this dynamic sector.

The Rise of Austin as a Semiconductor Equipment Hub

Austin’s journey to becoming a semiconductor equipment hub began decades ago when tech giants recognized the city’s potential. In the 1990s, companies like Samsung and Motorola (now NXP Semiconductors) established major operations in Austin, drawn by its proximity to top universities, skilled workforce, and favorable tax environment. These early investments laid the groundwork for a robust ecosystem that now includes equipment manufacturers, refurbishers, and service providers.

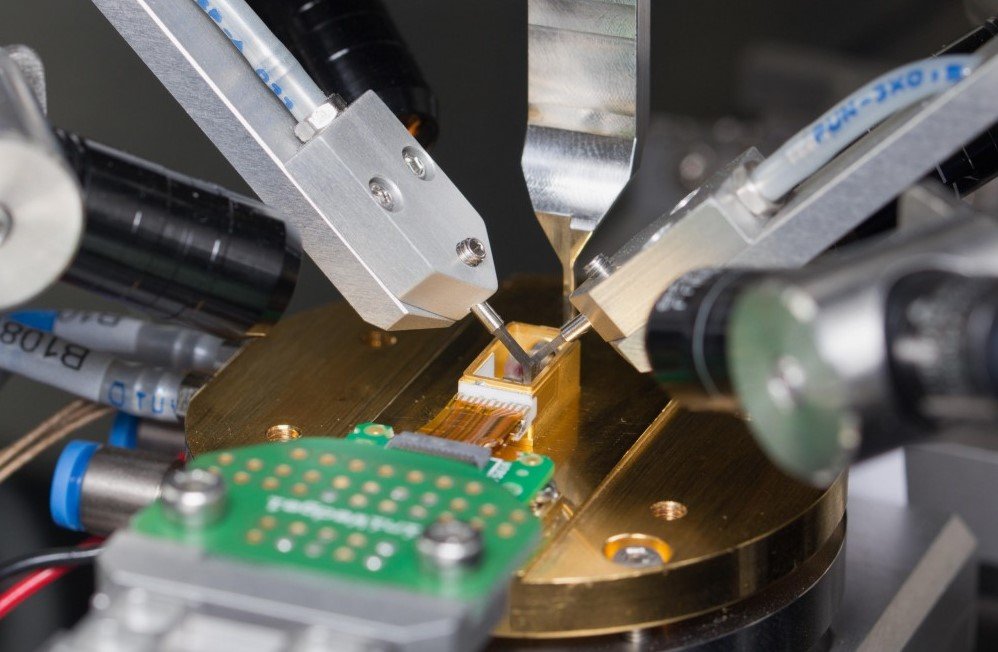

Unlike Silicon Valley, which focuses heavily on chip design, Austin has carved out a niche in the manufacturing and equipment side of the industry. This specialization has attracted companies that produce the complex tools needed to fabricate semiconductors, such as lithography machines, etching systems, and wafer-handling robots.

The city’s growth has been further fueled by federal initiatives like the CHIPS Act of 2022, which has spurred investment in domestic semiconductor production and equipment development. As a result, Austin has become a magnet for both established firms and startups looking to capitalize on the global demand for chips.

The semiconductor equipment industry in Austin is diverse, encompassing everything from the production of new machinery to the refurbishment of used equipment. Companies like Applied Materials, a global leader in semiconductor manufacturing tools, are expanding their presence in the region with plans for a $2 billion facility in nearby Hutto. This expansion highlights Austin’s role as a center for cutting-edge equipment innovation.

Meanwhile, smaller firms like Yerico Manufacturing in Elgin focus on repairing and refurbishing equipment, ensuring that chipmakers can maintain production without costly delays. This mix of large and small players creates a dynamic environment where innovation and practicality go hand in hand. Austin’s ability to support both ends of the spectrum has made it a critical node in the global semiconductor supply chain.

Key Players in Austin’s Semiconductor Equipment Industry

Several companies stand out as pillars of Austin’s semiconductor equipment landscape. Samsung Austin Semiconductor, a major player since 1996, operates two fabrication plants (fabs) in the city and is building a $17 billion facility in nearby Taylor. While Samsung is primarily known for chip production, its foundry operations rely heavily on advanced equipment, much of which is sourced or serviced locally.

This creates a ripple effect, supporting companies that provide maintenance, parts, and upgrades for Samsung’s tools. Similarly, NXP Semiconductors, with two large fabs in Austin, depends on a network of local equipment suppliers to keep its production lines running smoothly. These giants work closely with specialized firms like Fabworx, which enhances the performance of wafer-processing robots used in chip manufacturing.

Another key player is Moov, a startup with a dual headquarters in Austin and Tempe, Arizona. Founded in 2017, Moov operates a marketplace for pre-owned semiconductor equipment, helping chipmakers quickly source tools when new ones are unavailable or too expensive. This is particularly important during global chip shortages, as seen in recent years, when delays in equipment delivery can halt production.

Moov’s platform ensures accurate listings and fast transactions, making it a vital part of Austin’s equipment ecosystem. On the service side, companies like Conation Technologies and CrestTec offer refurbished equipment and custom solutions to optimize manufacturing processes. These firms leverage decades of expertise to reduce downtime and improve yields, which are critical for chipmakers’ profitability. Together, these companies illustrate the depth and diversity of Austin’s semiconductor equipment industry.

Economic and Educational Drivers of Growth

Austin’s semiconductor equipment industry thrives because of strong economic and educational foundations. Texas’s business-friendly policies, including low taxes and minimal regulations, make it an attractive destination for tech companies. The state’s investment in infrastructure, such as the 1,200-acre site for Samsung’s Taylor fab, supports large-scale manufacturing projects.

Additionally, the CHIPS Act has provided federal funding and tax incentives, encouraging companies like Applied Materials and Samsung to expand their operations in Central Texas. These investments create thousands of high-paying jobs, from engineers to technicians, boosting the local economy. For example, Samsung’s Taylor facility is expected to create 1,800 direct jobs and thousands more indirectly through suppliers and service providers.

Education plays an equally important role in Austin’s success. The University of Texas at Austin (UT Austin) is a global leader in engineering and computer science, producing a steady stream of talent for the semiconductor industry. UT’s Cockrell School of Engineering collaborates with companies like Samsung and NXP to train students in semiconductor manufacturing and equipment maintenance.

Austin Community College (ACC) also plays a critical role, offering hands-on training programs in state-of-the-art facilities. ACC’s partnerships with local employers ensure that its curriculum aligns with industry needs, preparing students for roles like semiconductor technicians. These educational institutions create a pipeline of skilled workers, making Austin an appealing location for companies that rely on specialized expertise. The presence of such talent also attracts equipment startups, as seen with Moov’s decision to establish a second headquarters in Austin to tap into the city’s talent pool.

Challenges and Opportunities in the Semiconductor Equipment Sector

Despite its strengths, Austin’s semiconductor equipment industry faces challenges that could shape its future. One major issue is the global supply chain’s complexity. Semiconductor equipment relies on hundreds of specialized components, many sourced internationally, which can lead to delays during disruptions like the COVID-19 pandemic.

Local companies like Austin Seal, Moov and Conation help mitigate this by offering refurbished equipment and rapid repair services, but the industry still needs more resilient supply chains. Another challenge is the high cost of innovation. Developing new equipment, such as advanced lithography systems, requires billions of dollars in R&D, which can strain smaller firms. However, Austin’s collaborative ecosystem, where large companies partner with startups, helps share the burden and drive innovation.

Opportunities abound as well. The global demand for semiconductors is skyrocketing, driven by trends like artificial intelligence, 5G, and electric vehicles. This creates a need for more advanced equipment, and Austin is well-positioned to meet it. The city’s proximity to major chipmakers like Samsung and NXP allows equipment providers to test and refine their tools in real-world settings, giving them a competitive edge.

Additionally, federal and state initiatives, such as the FABS Act, offer tax credits for equipment manufacturing, incentivizing further investment. Austin’s reputation as a tech hub also attracts talent and capital, fostering startups that can disrupt the equipment market with innovative solutions. For instance, companies like Fabworx are developing hardware upgrades that extend the life of existing tools, offering cost-effective alternatives to new purchases.

The Future of Semiconductor Equipment in Austin

Looking ahead, Austin’s semiconductor equipment industry is poised for continued growth. The city’s strategic investments in infrastructure, education, and innovation create a strong foundation for long-term success. Samsung’s planned $167 billion expansion in Taylor and Manor, combined with Applied Materials’ Hutto facility, signals confidence in Austin’s potential.

These projects will likely draw more equipment suppliers and service providers to the region, creating a self-reinforcing cycle of growth. Moreover, Austin’s focus on sustainability, as seen in Fabworx’s environmentally conscious approach, aligns with global trends toward greener manufacturing. This could position the city as a leader in eco-friendly semiconductor equipment solutions. The global semiconductor market is expected to grow significantly in the coming years, and Austin’s equipment sector will play a pivotal role.

By leveraging its talent, infrastructure, and collaborative spirit, the city can maintain its edge in this competitive industry. Whether through cutting-edge tools from Applied Materials or innovative marketplaces like Moov, Austin is shaping the future of semiconductor manufacturing. As demand for chips continues to rise, the city’s equipment providers will remain at the forefront, driving technological progress and economic prosperity in Silicon Hills and beyond.

One thought on “Semiconductor Equipment in Austin: A Hub of Innovation and Growth”

Comments are closed.