Investing can feel overwhelming, can’t it? You turn on the news and hear about market crashes, record highs, cryptocurrencies, real estate booms, and “once-in-a-lifetime opportunities.” It’s enough to make anyone freeze.

But here’s the truth: smart investing isn’t about chasing headlines. It’s about making thoughtful, informed decisions that align with your goals and values. That’s where the idea of an investors’ advocate comes in — someone who stands on the side of everyday people, helping them navigate complex financial waters with clarity and confidence.

The philosophy behind Payson Hunter centers on this very idea: empowering individuals with practical knowledge so they can make smarter investment choices without feeling intimidated or misled.

Why Investment Advocacy Matters

Let’s start with a simple question: who is really looking out for you when you invest?

Banks have products to sell. Brokers earn commissions. Financial influencers chase clicks. But an investor’s advocate puts your interests first. That means transparency, education, and empowerment.

Investment advocacy is about shifting the balance of power. Instead of feeling like you’re at the mercy of complex systems, you become informed and confident. Think of it like having a compass in a dense forest — you may not know every tree, but you know which direction you’re heading.

When you understand your rights, your risks, and your responsibilities, you stop being reactive. You become proactive.

Understanding Your Financial Goals

Before you invest a single dollar, ask yourself: What am I investing for?

Are you saving for retirement? A house? Your child’s education? Or maybe financial freedom?

Short-Term vs Long-Term Goals

Short-term goals (1–3 years) require safer investments. Long-term goals (10+ years) allow for more growth-focused strategies.

If you don’t define your destination, any road will do — and that’s risky. Clear goals help you choose the right investment vehicle.

SMART Financial Planning

Make your goals:

- Specific

- Measurable

- Achievable

- Relevant

- Time-bound

Instead of saying, “I want to be rich,” say, “I want to build a $500,000 retirement portfolio in 20 years.”

See the difference?

The Power of Long-Term Thinking

Have you noticed how often people panic during market dips? It’s natural. But history shows that markets tend to grow over time.

Compounding: Your Silent Partner

Compounding is like planting a tree. At first, growth is slow. But over time, branches multiply. Your earnings start earning their own earnings.

The longer you stay invested, the more powerful compounding becomes.

Patience Pays

Imagine checking your oven every 30 seconds while baking a cake. You’d never let it cook properly. Investing works the same way. Constantly reacting to short-term fluctuations often hurts returns.

Long-term thinking reduces stress and improves outcomes.

Risk: Friend or Foe?

Risk sounds scary, doesn’t it? But without risk, there’s usually no reward.

The key isn’t avoiding risk entirely. It’s managing it wisely.

Types of Risk

- Market risk

- Inflation risk

- Interest rate risk

- Company-specific risk

Understanding these risks helps you make informed choices instead of emotional ones.

Your Personal Risk Tolerance

Are you comfortable with ups and downs? Or do you lose sleep when markets fall?

Be honest with yourself. Investing should align with your personality. There’s no shame in being cautious.

Diversification: Don’t Put All Eggs in One Basket

We’ve all heard the phrase, right? But what does it really mean?

Diversification spreads your investments across different assets to reduce risk.

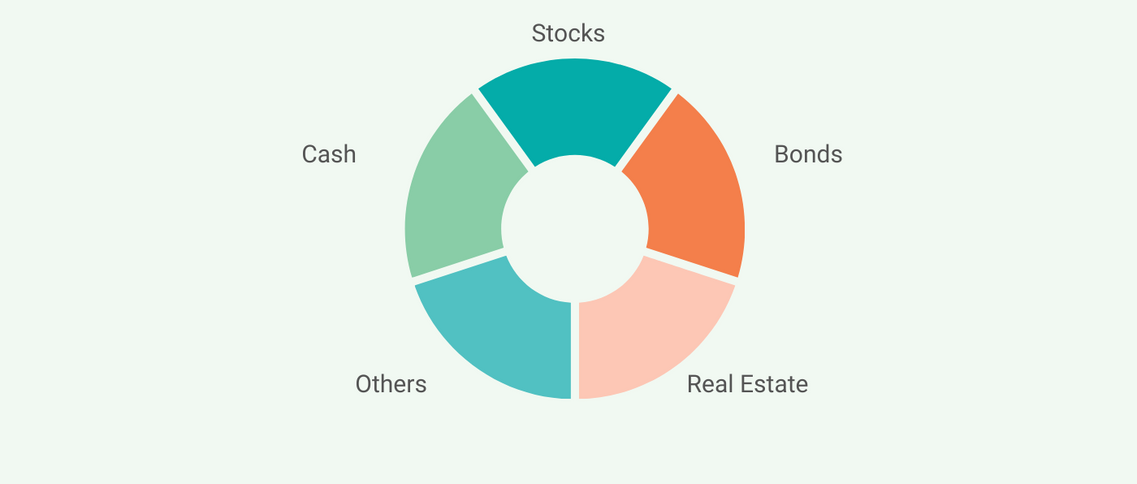

Visualizing Diversification

Asset Classes to Consider

- Stocks

- Bonds

- Real Estate

- Cash equivalents

When one asset dips, another might rise. Diversification acts like shock absorbers in a car — smoothing the ride over financial bumps.

Global Diversification

Don’t just invest in your home country. Economies grow at different speeds. Expanding globally spreads opportunity.

The Emotional Side of Investing

Let’s be real — investing is emotional.

Fear and greed drive markets. When everyone is buying, we feel excited. When everyone is selling, we panic.

Behavioral Biases

- Herd mentality

- Overconfidence

- Loss aversion

Recognizing these biases is half the battle.

Building Emotional Discipline

Set rules in advance:

- Rebalance annually

- Avoid checking daily prices

- Don’t make decisions based on headlines

Your greatest enemy in investing often isn’t the market. It’s your emotions.

How to Evaluate Investment Opportunities

Before jumping into any opportunity, pause and ask:

- Do I understand this investment?

- What are the fees?

- What are the risks?

- How does this fit my goals?

Reading the Fine Print

Fees can quietly eat into returns. Even a 1% difference over decades can cost thousands.

Red Flags

- Guaranteed high returns

- Pressure to act immediately

- Lack of transparency

If something feels too good to be true, it probably is.

Avoiding Common Investment Mistakes

We all make mistakes. The goal is to avoid the expensive ones.

Chasing Trends

Remember when everyone rushed into a “hot stock” only to see it crash later? Trend chasing often leads to buying high and selling low.

Timing the Market

Trying to predict market highs and lows is nearly impossible — even for professionals.

Instead, focus on consistency. Regular investing smooths out volatility.

Building a Balanced Portfolio

A balanced portfolio reflects your goals, time horizon, and risk tolerance.

Example of Asset Allocation

Age-Based Allocation

A simple rule of thumb: younger investors can hold more stocks; older investors may shift toward bonds.

But remember — rules are guidelines, not strict laws.

Rebalancing

Over time, your portfolio drifts. Rebalancing restores your original plan. Think of it like realigning your car wheels to avoid uneven wear.

The Role of Financial Advisors

Do you need a financial advisor?

It depends.

When Advisors Help

- Complex tax situations

- Estate planning

- Retirement strategy

Choosing the Right Advisor

Look for:

- Fiduciary responsibility

- Transparent fee structure

- Clear communication

An advisor should educate you, not confuse you.

Technology and Modern Investing

Technology has changed everything.

Apps allow instant trading. Robo-advisors automate portfolios. Online platforms provide global access.

Pros

- Lower fees

- Accessibility

- Convenience

Cons

- Overtrading temptation

- Information overload

Technology is a powerful tool — but like any tool, it must be used wisely.

Ethical and Responsible Investing

More people now want their investments to reflect their values.

Sustainable Investing

This approach considers environmental, social, and governance (ESG) factors.

You can support clean energy, fair labor practices, or ethical leadership while still pursuing returns.

Aligning Money with Values

Ask yourself: Does this company align with my beliefs?

Profit and purpose don’t have to be enemies.

Monitoring and Adjusting Your Strategy

Investing isn’t “set it and forget it” forever.

Annual Reviews

Review:

- Asset allocation

- Performance

- Goal alignment

Life Changes Matter

Marriage, children, career shifts — these affect your financial strategy.

Adjust accordingly.

Creating Your Personal Investment Blueprint

Now it’s time to bring everything together.

Step 1: Define Goals

Be specific and realistic.

Step 2: Assess Risk Tolerance

Know your comfort zone.

Step 3: Diversify

Spread investments across assets.

Step 4: Automate Contributions

Consistency beats timing.

Step 5: Review and Adjust

Stay flexible.

Think of your investment plan as a roadmap. Without one, you wander. With one, even detours won’t derail you.

Conclusion:

At the end of the day, smart investing isn’t about being a genius. It’s about being disciplined, informed, and patient.

When you embrace the mindset of an investors’ advocate — one that prioritizes education, transparency, and long-term thinking — you take control of your financial future.

You don’t need to predict the next market boom. You don’t need insider knowledge. What you need is a plan, emotional discipline, and the willingness to learn.

Whether inspired by the principles associated with Payson Hunter or guided by your own commitment to financial literacy, the goal is the same: make decisions that serve you, not someone else’s agenda.

Your money represents your time, effort, and dreams. Treat it with care. Invest with intention. And remember — the smartest investor isn’t the loudest one in the room. It’s the one who stays steady, informed, and focused on the long game.

FAQs

1. What does it mean to be an investors’ advocate?

It means prioritizing the investor’s best interests through education, transparency, and informed decision-making rather than sales-driven advice.

2. How much money do I need to start investing?

You can start with small amounts thanks to modern platforms. The key is consistency, not size.

3. Is diversification really necessary?

Yes. Diversification reduces risk by spreading investments across multiple assets, helping smooth market volatility.

4. Should I invest during market downturns?

Market downturns can present opportunities if you have a long-term plan. Staying consistent often matters more than timing.

5. How often should I review my investment portfolio?

At least once a year, or whenever major life changes occur, to ensure alignment with your goals and risk tolerance.